Just to break up the monotony of summer, it appears the so-called SECURE Act is working its way through Congress. The bill is meant to increase retirement savings and allow for longer deferral of those retirement funds. But there is a downside to this potential law as well.

First, some background. Current law requires IRA, 401(k), 403(b), etc. owners to take distributions once they reach the age of 70.5. The exact amount of this Required Minimum Distribution (RMD) is based on the account valuations and the taxpayers actuarial life expectancy. As the owner ages, the amount of RMD increases as a percentage of the total accounts (ie the owner’s expected life shortens each year). When the taxpayer dies the retirement account are transferred tax free to a spouse who continues the process.

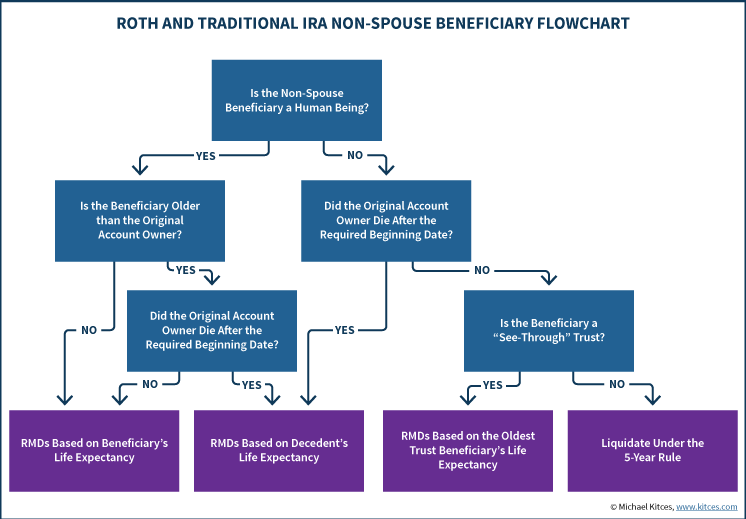

But what if you don’t have a spouse or the individual wishes to pass their retirement account to someone other than his/her spouse? In that case, a non-spousal beneficiary (child, grandchild, etc.) is named a beneficiary and they could then “stretch” the RMD over their much longer life expectancy (Note stretch only works for an IRA…401(k) and 403(b) can only pass on to children and receive the longer RMD period). Here is a flowchart for IRA requirements (credit to Michael Kitces kitces.com)

So it should be obvious that Stretch IRAs provide an opportunity for taxpayers and their beneficiaries to defer taxes over LONG periods of time. This is a huge planning opportunity for those with significant asset bases that want to leave assets for children and grandchildren.

Well, the SECURE Act would change this. This new law requires ALL non-spousal beneficiaries to withdraw inherited IRAs over 10 years. No exceptions, no elections. Just pull out the money ratably over a 10 year period. Gone is the option to Stretch the IRA distributions over a number of years (or even generationally). This will be a huge change in IRA distribution strategy.

In addition, the RMD age will be pushed back to 72. With longer life expectancies I’m not surprised this change is being considered.

There are a few other items in the SECURE Act but these seem to be the most impactful. Once the final bill is signed into law we will analyze any other provisions that have meaningful impact. This bill has already passed the House in May and seems poised to do so in the Senate. Based on all of the reporting I have read it seems the die is cast: The SECURE Act will eventually become law. No word on whether the old rules will be grandfathered in some way.

If you have IRA assets that you will be leaving to non-spouses, please feel free to contact us to determine the impact on the SECURE Act on you and your heirs.