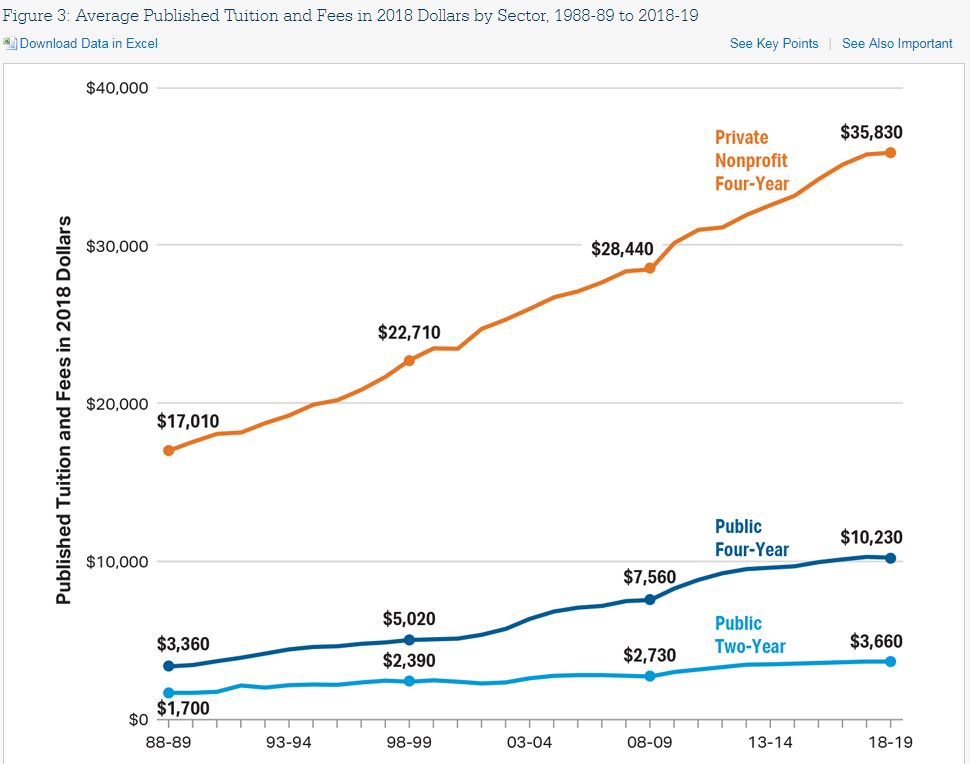

Educational accessibility and the associated costs seem primed to be a benchmark issue in the 2020 presidential election. Costs have skyrocketed over the last 30+ years and show no sign of slowing down (below from College Board.org)

Note these are actual cost increases using 2018 dollars as a benchmark. Along with this increase has come an explosion in student loans both by parents and the students. This, of course, has created a hot button political issue with proposals from 2 leading Democrat candidates in the last 2 weeks alone:

First, Elizabeth Warren’s proposal

Not to be outdone, Bernie’s proposal

I can’t imagine either of these proposals will ever be voted on in their current form (much less passed) but the fact that these candidates are even talking about it makes it clear that this is something they believe the country is passionate about. So what are the options to avoid saddling our kids with student loans while still saving for retirement, paying a mortgage, etc.

529 Plans

Clearly the most tax efficient savings vehicle for education costs, 529 plans are sponsored by states and offered through any number of investment providers. Generally, there is no limitation to the savings plans based on state. In other words, a MD resident can utilize a MD plan even if their kid ultimately goes to school in VA (or anywhere else). Some states offer a front-end tax benefit (deduction) at the point of contribution. But the real benefit is that if the funds are used for qualifying education purposes the growth is not taxed. Thus, the longer the funds are invested and the more growth realized in the 529 plan investment, the larger this tax benefit. If you are saving for a child’s education it should almost always be done through a 529 plan.

Home Equity Loans

These are no longer as attractive as they were prior to the 2017 tax act. Home equity loans borrowed for anything but expenses or improvements related to the house no longer carry a deduction for the interest paid. But that doesn’t mean this is a bad option for actually paying the college costs. Many parents largest equity asset is their home and therefore unlocking that equity often makes sense.

Financial Aid

Obviously this can come in many forms and flavors. In order to obtain any financial aid, a FAFSA form is generally required. This form (coupled with supporting documentation) determines the amount of need based or other aid that a school is going to offer. It also determines qualification for governmental programs including grants and loans. For anyone who has filled out the FAFSA–it is a pain in the A$@. I have helped clients fill them out and am amazed at the level of information required. But it is what it is…if you want to apply for the aid you have to go through the process.

Tax Credits

If a taxpayer does borrow money to pay for college several states have tax advantages for interest paid and 2 states offer a tax credit for repayment of those loans. Notably, Maryland has an annually renewing program called the Student Debt Relief Tax Credit. This is only for MD residents with at least $20k in student loan debt. There is a hierarchy of who qualifies and for how much but if you meet the criteria there is no reason NOT to at least apply.

We shall see how the political landscape handles this issue over the next 18 months or so. My guess is that a lot of noise will be made about it but in the end any improvements to the student loan crises will be minimal. I think taking on a bunch of student loan debt with the expectation that it will be forgiven under a President Sanders is a heck of a risk to take. Hopefully that is not the route that students and their parents take when looking at funding options.