Happy New Year to all! 2019 was a whirlwind of events, and 2020 seems headed in the same direction.

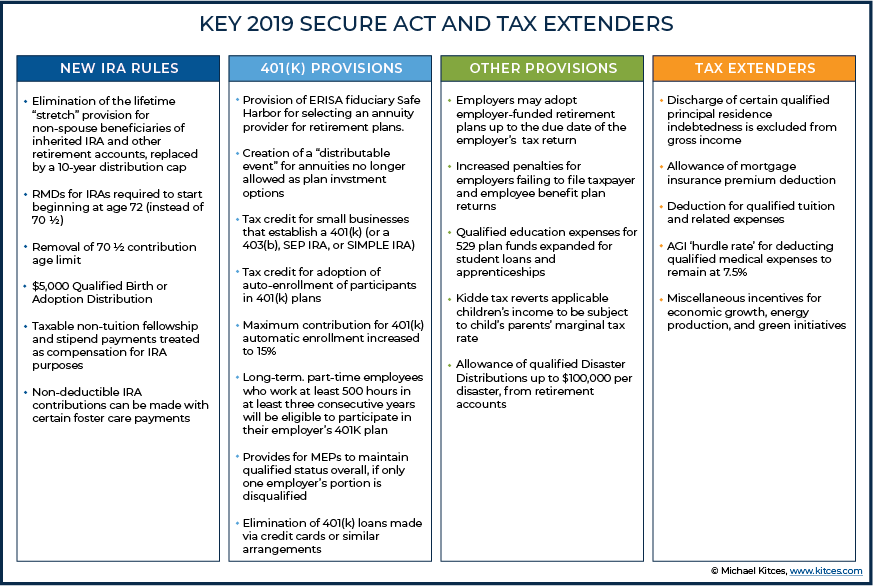

(Chart via Michael Kitces www.kitces.com)

I wrote about the SECURE Act last July, seen here: SECURE Act. At that point, the bill had passed the House and was looking for an avenue for passage in the Senate. Well, the bill appeared DOA until it was attached to a larger appropriation bill passed in December and signed into law by the President. While nowhere nearly as broad in scope as the Tax Cuts and Jobs Act of 2017 (TCJA), there are still some interesting changes to be aware of. So, here are the highlights:

No More Stretch IRAs

One key feature is the elimination of the so-called “stretch” provisions for most non-spouse beneficiaries of retirement accounts. What does that mean? Basically, most inherited retirement accounts will have to be fully liquidated within a 10-year time period. Previously, inherited accounts had the option of “stretching” distributions over the beneficiaries’ lifetime. There are some planning opportunities here though; not least of which is the flexibility of WHEN accounts are liquidated. For example, if a beneficiary knows their income will be considerably lower at some point over the 10-year period, they could time the distributions to include only those years of lower income. This is decidedly different from the old law where consecutive annual distributions were a requirement.

Increased Required Minimum Distribution (RMD) Age

For years, the RMD age was 70.5. That meant that once a taxpayer reached 70.5, some distributions from their retirement accounts were mandatory. That age has been increased, starting in 2020, to 72. Not a huge deal, but for those that don’t “need” the retirement distributions at 70.5, it does provide some additional time for tax deferral.

Penalty-Free Distribution

This one is interesting. The SECURE Act allows for a penalty-free distribution of up to $5,000 for a qualified birth or adoption. The distribution is still taxable, of course, but the normal 10% penalty for taxpayers under age 59.5 is waived starting in 2020. The proceeds from that distribution do not have to be for any specific purpose or expense.

Kiddie Tax

The 2017 TCJA was not kind to unearned income of dependents (interest, dividends and capital gains). The TCJA calculated the tax on these income sources as if they were trust income starting at a very low level. We most commonly saw the impact of this change in cases where taxpayers liquidated UGMA accounts for their children and used the proceeds to pay for college tuition. TCJA Kiddie Tax often resulted in larger tax bills than Pre-TCJA Kiddie Tax, and in some cases, considerably higher bills. SECURE returns Kiddie Tax calculations to the prior methodology.

Rising Student Loans Problem

SECURE has a little-known provision that will allow 529 plan owners to distribute 529 amounts to beneficiaries to pay down their student loans. The maximum allowable distribution for this purpose is $10,000 (lifetime amount). There is even a methodology that will allow the account owner to use 529 balances to pay down the beneficiaries sibling’s balances (same $10k lifetime maximum).

While there are other more targeted and specific provisions in SECURE, these are the key highlights. Do not hesitate to reach out to discuss these or any other related issues that impact you and your family.

I hope you all enjoy a healthy and happy 2020, and I look forward to connecting with you soon.