Probably the provision from last December’s Tax Cut and Jobs Act (TCJA) I hear the most questions about is the deductibility of taxes paid. This issue has even been in the news quite a bit recently. Several states (MD included) have sued over the perceive as an unfair reduction in this tax deduction for their residents. Several states have implemented work-arounds that will likely be challenged by the IRS. But as mentioned there is a lot of confusion about what the new law allows and what it doesn’t with respect to SALT (state and local taxes).

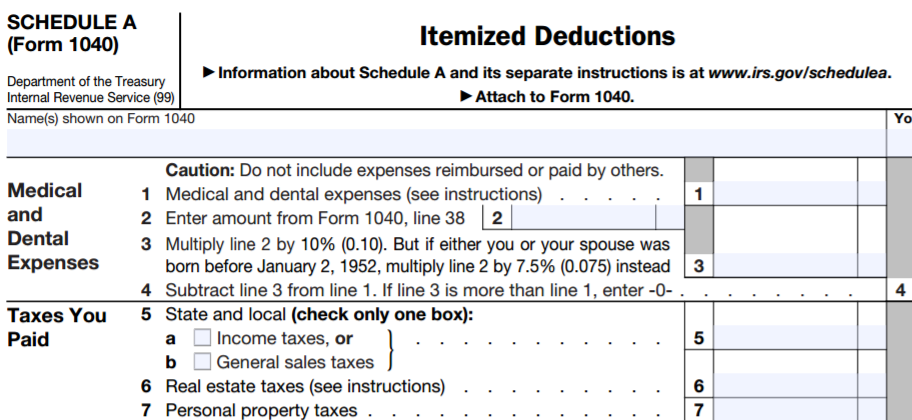

In order to understand the controversy and how the new law stirred all of this up. Prior to the enactment of the TCJA, taxes paid were deductible when paid without limitation as an itemized deduction.

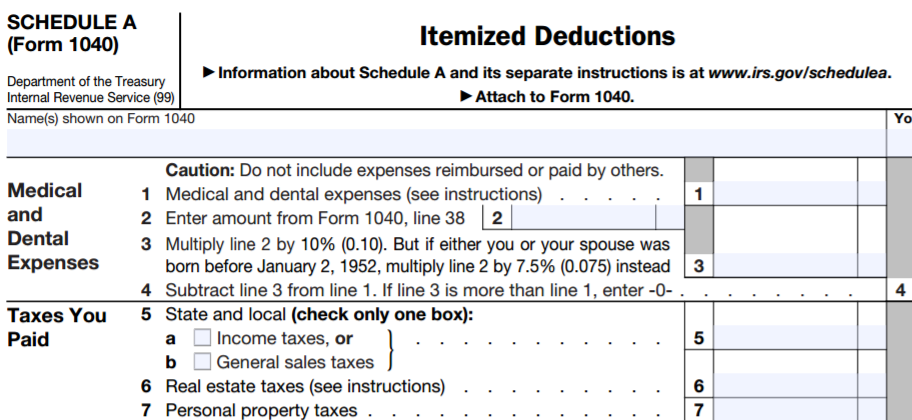

As you can see from the image above we aggregate state and local income taxes paid, real estate taxes paid and personal property taxes paid and come up with a taxes paid deduction (there are other allowable taxes that could be deducted but these are the most common ones). Obviously a taxpayer living in a high tax state will pay more in state tax than someone living in a zero tax state. Thus, the taxes paid by a New York resident would increase their itemized deductions and, all else being equal, they would pay less federal tax than a Florida resident.

TCJA

So what changed? The new tax law limits the “Taxes You Paid” section of itemized deductions to a maximum total of $10k. If you pay $4k in real estate taxes then you will only be able to deduct an additional $6k of state income taxes paid. The rest of your taxes paid are simply considered non-deductible. This change will disproportionately impact higher income taxpayers in high tax states and taxpayers where property taxes are high relative to other states.

So does this mean I will Pay More Tax?

Not necessarily. While the taxes paid deduction has been capped far fewer taxpayers will be subject to the Alternative Minimum Tax (AMT) starting in tax year 2018. Taxes paid are not a deduction in calculating AMT. So a taxpayer in AMT didn’t get the benefit of this deduction under the old tax law anyway. In addition, fewer taxpayers will be itemizing their deductions due to the increase in the standard deduction. If a taxpayer does not itemize they obviously don’t realize the benefit of the deduction for items on Schedule A. Finally, tax rates and tax brackets have changed and should have a large impact on each taxpayer’s individual tax situation.

As with almost all things tax, the impact on every taxpayer will be different. If you want to better understand how this change in deductibility will impact you, please feel free to reach out to us.