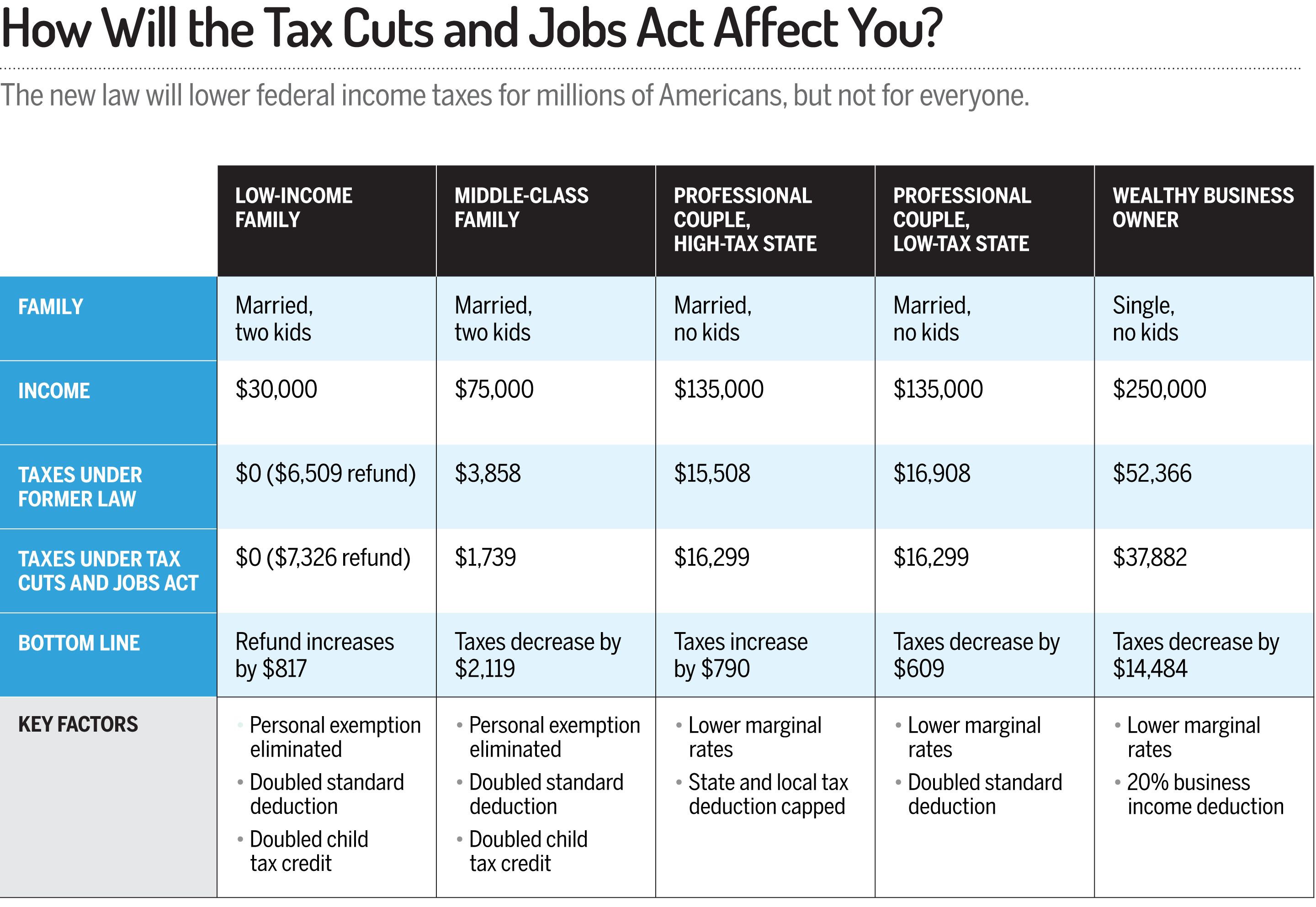

As everyone knows by now, the 2018 tax landscape is a marked shift from prior years. Virtually every taxpayer’s return will look different in some way come next tax filing season. Here is a Money magazine chart displaying the impact of the tax change across differing income and filing statuses (I think I may have used this chart previously)

Obviously every family’s situation is different. But the key takeaway is that almost all taxpayers will see a lower total tax burden for 2018. So we don’t need to do anything and can simply expect a larger refund next April? Not exactly. Here a few scenarios that taxpayers need to be wary of.

Lower Withholding

Those of you that are employed likely noticed that you began receiving extra take home pay when the IRS withholding tables changed in late February. If your withholding was reduced by more than the reduction in your tax for the year, you may have a smaller refund than expected. The reality is it is impossible to know for sure without running the numbers.

High Tax States

For clients that live in a high tax state (CA, NY, NJ, CT and likely MD) your tax bill in 2018 MAY be higher than 2017. I detailed what all of this means in my last post:

Again it is impossible to know for sure if the changes will increase your tax bill without running the numbers.

Misc Deductions

Taxpayers that previously wrote off a lot of misc deductions (primarily unreimbursed employee expenses and investment advisory fees) will recall that these deductions are NO LONGER allowable. No phaseouts, no limitations; they simply aren’t deductible items any longer. The loss of these deductions MAY increase your federal tax burden. Please make certain you are taking full advantage of your employer’s expense reimbursement policy.

These are but 3 of the items that may lead to tax surprises next spring. If any of these are applicable to you or you just want reassurance that you won’t have a large tax bill due next spring, please get in touch with us this fall.