As I read through the financial blogs, tweets and traditional media outlets this weekend one thing that was obvious is that there are no shortage of opinions of why last week’s volatility happened. As I detailed last Monday, there are a host of reasons why investors (or traders) sell. And while there are always many reasons, it’s not unreasonable to believe that the largest factor in last week’s drawdown was risk of rising interest rates. Fundamentally, nothing seems to have changed with respect to corporate profits, consumer spending, or any of a thousand data points that are discussed ad nauseum on CNBC and elsewhere. Instead, the looming reality of rising interest rates seems to have diminished investors appetite for risk assets. That seems the best explanation to me.

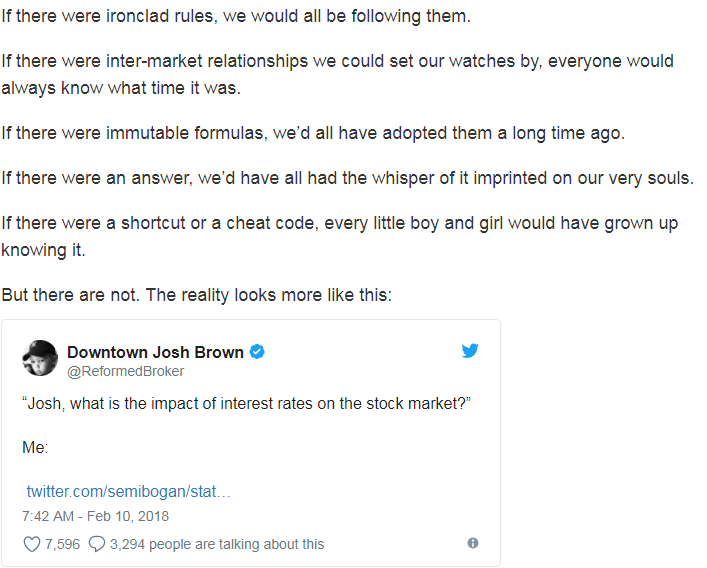

The question now is, “What comes next?” And as I often respond to that question, “I don’t pretend to know”. If you pay any attention to the financial press, you will hear untold number of analysts, chart readers, bloggers, etc. giving specific predictions of what will happen in the coming weeks. They will rely on charts, formulas, back tested data and any other means necessary to support their predictions. But these people are essentially carnival barking. Expecting to make specific short term calls on the markets which are incredibly complicated, living, breathing entities is arrogance at a minimum (and perhaps worse). Of course, as I was trying to articulate this thought process @ReformedBroker beat me to the punch and hit it out of the park. As he so often does, Josh calls it like it is and hones in directly on the reality of these market prognosticators:

Read his whole post about this subject here: http://thereformedbroker.com/2018/02/11/be-terrified/

As always, if you have any questions about your financial plan or how we can assist you, please do not hesitate to contact us.