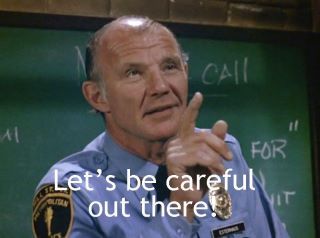

For those as old as me you likely remember this line from the 80’s police drama Hill Street Blues. And while the admonishment Sergeant Esterhaus closed every meeting with was intended to keep his fellow officers safe in the fictional Hill Street precinct, the warning equally applies to investors. It is your money and some of the brightest minds on Wall Street would like nothing better than to take a slice of your investment pie. Just this week two major investment houses were in the financial news for less than savory sales practices:

Wells Fargo, on the heels of a series of issues for the large bank, is reportedly being looked at in connection with putting investors in unsuitable investment vehicles, presumably ones with higher compensation structures for the “advisor”:

https://www.cnbc.com/2018/03/01/wells-fargo-again-faces-sales-scrutiny-this-time-in-its-wealth-advice-division-wsj-says.html

Not to be outdone, Ameriprise (amongst a slew of others) was fined by the SEC for putting retirement clients in higher fee investment vehicles between 2010 and 2015.

https://www.cnbc.com/2018/02/28/ameriprise-put-retirement-savers-at-disavantage-sec-says.html

Just last fall, TIAA-CREF, long thought to be a “selfless steward of its client’s assets”, was investigated by the New York Times resulting in a series of lawsuits for guess what?…putting client retirement assets in unsuitable investment vehicles with higher compensation models and higher expense ratios.

https://www.bloomberg.com/gadfly/articles/2017-11-01/tiaa-s-devotion-to-its-customers-can-start-with-fees

So now that the fiduciary rule appears to be DOA it is incumbent on investors to do their due diligence and ask tough questions. In any other industry, consumers expect to know exactly what they are paying for the product they are purchasing. In the financial advisory world, many consumers who would drive across town to save 5c/gallon on gas, simply go with the recommendation their “advisor” makes. Yet this industry must be based on trust. But trust goes both ways. Consumers of financial advice deserve to understand their advisor’s compensation and what other investment options are available. Trust is earned from day one and continually earned throughout a relationship.

This post certainly does not imply that the lowest cost investment is the best investment. That would be extremely shortsighted. Rather consumers need to understand and ultimately trust that their advisor will do right by them. The best way to get to that point is to ask questions. If the advisor is unwilling or unable to answer those direct questions, particularly about their compensation that you are paying, my recommendation is to get out of their office.