The SECURE ACT 2.0 was signed into law in late 2022 and became effective January 1, 2023. Unfortunately, this new law further complicates an already complicated set of rules, particularly as it relates to required minimum distributions (RMDs).

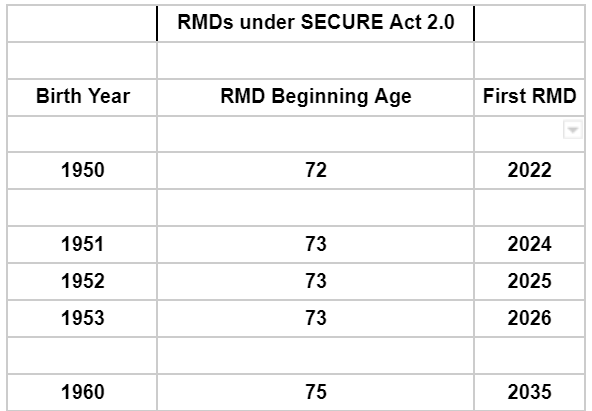

Prior to the changes spelled out in SECURE Act 2.0, RMDs were necessary once a retirement account owner turned 72. So for taxpayers born in 1950 or prior, they should already be taking RMDs for tax year 2022 and (possibly) prior. This group of individuals are not impacted by these RMD age related changes.

However, with the implementation of the SECURE Act 2.0 the RMD age has been increased to 73. So that means that taxpayers born in 1951 can delay RMDs until calendar 2024. That subset of retirement account owners has NO RMD requirement in 2023.

And just for giggles, the law has yet another increase to the RMD age for those born on or after 1960. That grouping of taxpayers will not have to start RMDs until age 75. Below is a table which hopefully makes this a bit clearer.

In any year, taxpayers are allowed to take distributions prior to reaching their RMD age (assuming over age 59 1/2).

Planning Opportunity: If you are retired but have not yet reached your RMD age, it MAY make sense to consider withdrawals before RMDs are required. This is a case-by-case calculation but we have had clients save considerable taxes by starting withdrawals (or doing ROTH conversions) prior to their RMD year.

Please reach out if you would like additional information related to RMDs. The rules and requirements surrounding RMDs are very confusing and mistakes made with respect to withdrawals are often unable to be remedied after the fact.