After one of the more bizarre years ever, we now find ourselves in 2021. Most notably to this office, that means the 2020 income tax filing season is coming fast. Below are my thoughts and a few warnings.

Stimulus Round #2

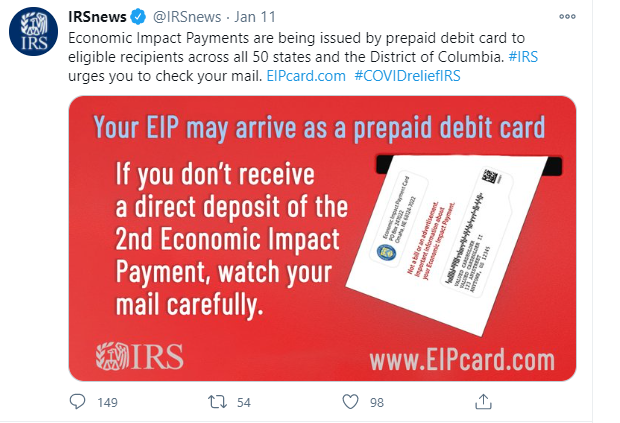

As you likely know the second round of stimulus payments was passed late in 2020 and payments started arriving in bank accounts in early January. The process SEEMS more organized than the first round but there are certainly glitches. Taxpayers that changed bank accounts do not have a mechanism to update their data. Additionally, about 8 million Americans will be receiving their payment in the form of a prepaid debit card mailed to the taxpayer’s address. Advocacy groups and the IRS are warning taxpayers to pay close attention to the mail since the mailings are being confused with scam mailings.

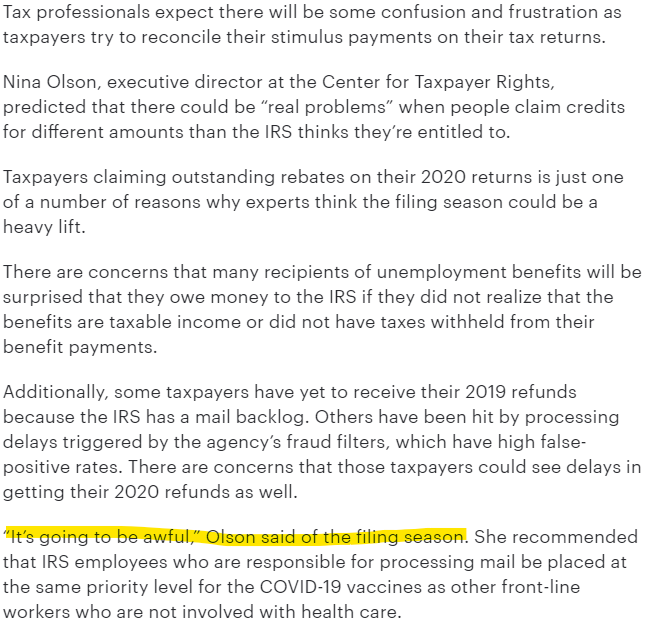

So this stimulus payment rollout will not be perfect. One thing to keep in mind, however; if you are entitled to either stimulus payment but did not receive it, we will claim a credit for the amount on your 2020 return. It will be CRITICAL that we document your receipt of any stimulus payments AND the exact amount received. IRS is already warning that a disconnect between what you claim on your return and what the IRS believe you are entitled to will slow the return processing. As someone in the business for over 25 years, I agree completely. I expect this to be a major filing issue this season.

IRS Backlog

Unsurprisingly, COVID and the many governmental responses taken to it have not been handled particularly well by IRS. Many of our clients have filed returns or mailed letter responses that seem to go into an abyss. This is quite a concern as we roll right into another filing season in the next 30 or so days.

Sadly, there is virtually nothing we can do about it. Phone calls often require 60 min or more hold times, responses often go unanswered, etc. It’s extremely frustrating and worrying for our clients. My hunch is that this will cause the 2021 filing season to compound the problem. These delays from last year will still be there and piling more returns into the pipeline is a recipe for a mess of a season.

The head of the Center for Taxpayer Rights says it succinctly above…”It’s going to be awful”.

Our Office

We continue to not see clients face to face at this point. My expectation is that policy will continue through this filing season. We have different ways for you to get us your tax data:

- Through our file sharing portal (many of you are already using this)

- Drop offs are fine…we have a bin to receive documents just outside of our office door

- Delivery (USPS, Fedex, UPS, etc.) Given the struggles of the USPS of late, I would encourage using a private delivery service

If there is an issue you want to go over and prefer “face to face” contact, we do have a Zoom account and can set up a Zoom call. Otherwise we can arrange an agreeable time to reach you by phone to discuss your tax situation. We are following the protocol we set up last March. It has worked well for us thus far and we are committed to continuing this method of doing business until otherwise directed.

We will be electronically filing EVERY return that we can. Certain returns are not allowed to be filed electronically for a variety of reasons but other than these exceptions returns will be electronically filed. That is how the IRS wants it and that is how we can assure receipt of your filing.

That should cover it. I hope my tone doesn’t come across as too negative. Rather, we are just trying to be realistic and work within the constraints put on us by this virus and the bureaucratic environment we work in.

If you have any questions, please do not hesitate to contact us. We look forward to working with you again this year and will work to make the process as efficient and painless as possible.