Over 4 years ago, I wrote this blog post Chasing Yield. Basically, my admonition for clients and investors was to not take on more risk than you are comfortable with simply to earn more yield. At that time, rates on the 10-year Treasury Bond were hovering in the 1.50% range. Fast forward to today, and those same bonds are currently yielding about half that amount with no increase in site. The Fed has made it clear that their intention is to maintain low interest rates for the foreseeable future (until at least 2023). Now, market interest rates aren’t set by the Fed, of course, but they are an important component in rates that banks charge to lend or that banks pay to depositors. Given the speed at which economic markets change these days, the Fed could change its stance. But if their stated position holds true through 2023, where does that leave bond holders?

Current Yields = Long Term Earnings

As a refresher, bond returns are inversely correlated to market interest rates. A bond (or a portfolio of bonds) is worth more when interest rates drop and worth less when interest rates rise. That is basic economics. If I have a bond that pays me 5% on my money, it will be worth more when market rates are 4%. If someone wants to buy my bond, they would pay me more for a bond yielding 5% than that same bond yielding a market rate of 4%. I, as the owner of that bond, also would not be interested in selling a $1,000 5% bond if my $1,000 has to be reinvested in another bond earning 4%. I’d just hold my 5% bond until it matures.

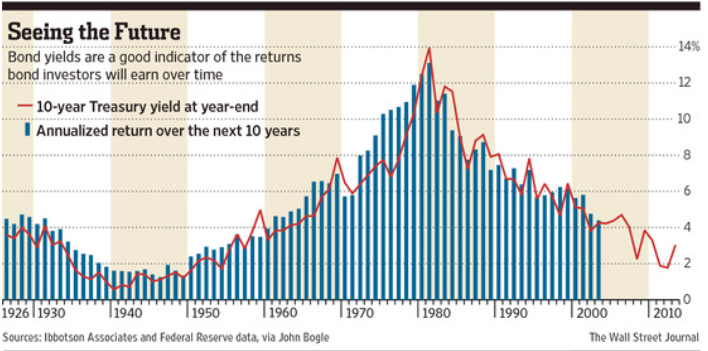

So with all of that in mind, how does one predict the return of a bond portfolio over a decade? Well, that is a really hard question, and there a ton of variables and what-ifs that can occur over the decade. But as a proxy for all of those calculations, we can look at current yields and use that as an estimator of what that bond portfolio will earn over a decade. It’s not an exact science, but it is a good proxy for return expectations. Here is a chart overlaying the 10-year yield and returns over the next 10 years dating back nearly 100 years.

So current 10-year yields are well under 1%….YIKES. If the above pattern holds true, 10-year Treasury returns would likely be under 1% as well. Not ideal. So what can be done?

Well, as I stated in the Chasing Yield blog post, there is no magic bullet. The “easy” answer is to embrace additional risk in the form of corporate bond portfolios, high yield bonds, dividend paying stocks, etc. Only that isn’t such an easy solution for risk-averse investors. These investments are not the same thing as a portfolio of Treasury bonds. Those alternatives come with additional uncertainty that Treasuries simply don’t have. If you want low risk investing with a decent yield…unfortunately it doesn’t exist as of this writing. You are out of luck.

And while that is tough to hear, it is true for all investors seeking yield. But, there are still reasons to invest in US Treasuries and similar securities. A similar recent post on Nick Maggiulli’s popular, “Of Dollars and Data” blog, presents a few reasons that make sense Why Own Bonds Now?

If you don’t like the current situation in bonds and feel it may hinder your retirement plans, I think there are 3 possible solutions to the issue:

- Save More-Saving more over your investment time frame can offset the lower return expectations.

- Save/Work Longer-Working longer means you can save longer AND, just as importantly, delay your savings withdrawals.

- Plan for Less– If you realize less return on your assets, you will have less of a nest egg when you need it. Planning to spend less in retirement is a reasonable plan of action in that case.

None of these options is particularly appealing. Unfortunately, the only other option is to take on more risk in your portfolios. Any of these approaches can work, but all have their positives and negatives. If you are concerned about the prospect of lower future returns, please feel free to contact us to discuss.