When speaking with clients of late I’ve sensed a lot of apprehension. I’ve probably heard the same thought process for the last 10-ish years since this current bull market began. And yet the financial markets and the economy in general, chug along producing favorable results. Why is there so much apprehension?

Political Headwinds

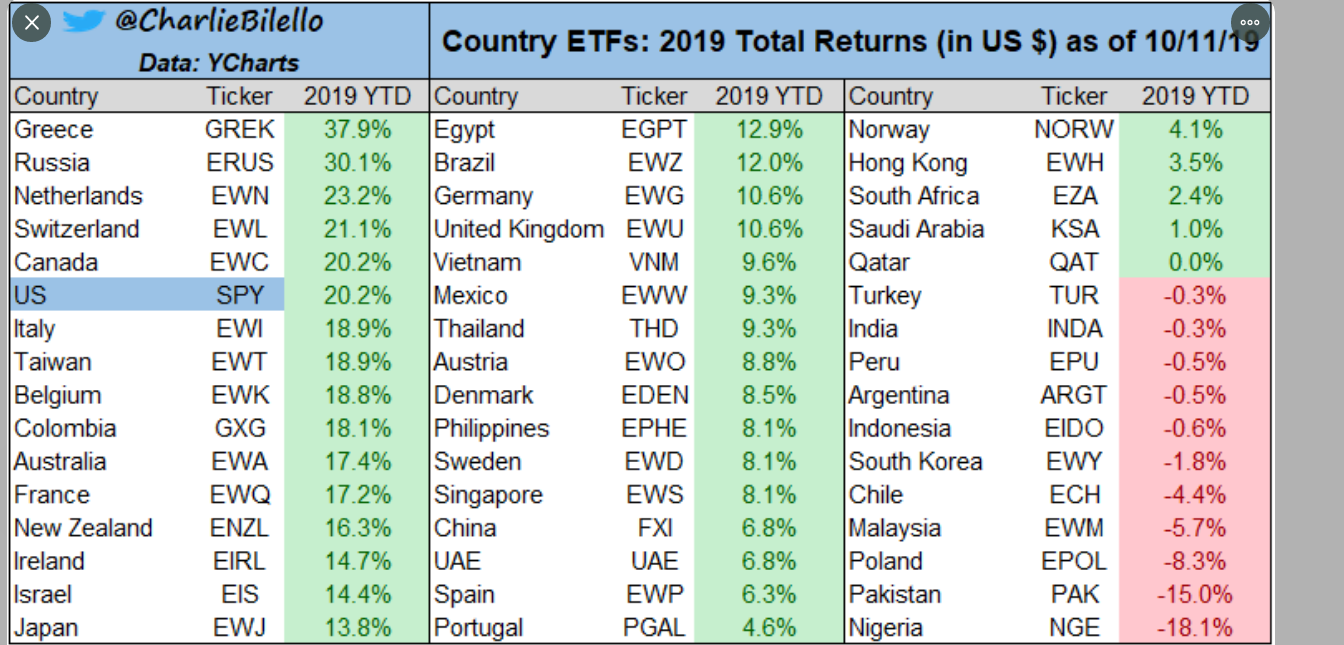

It’s clear that there are politically uncertainties that traditionally scare the markets. Those uncertainties are all over the world not just right here in our backyard. From London to Hong Kong to South America to Washington and virtually everywhere in between there is political upheaval and, in some cases, fear. Financial markets tend not to like uncertainty. Generally they react negatively to it. That seems not to be the case currently (albeit several indices are off their year-to-date highs). The below chart from Charlie Biilello visually shows the market performances across the world (through Oct 11)

That’s a lot of green. Incredibly, with all of the talk of impeachment, nasty political races and social media that is often bordering on toxic, the US markets are near the top of this chart for 2019.

Inflationary Pressures

But political risks are not the only ones faced by the markets. With the unemployment rate hovering around a 50 year low (~3.5%) and jobs growth entering it’s 9th year of continued upward trend there is fear of a shrinking labor pool. This generally leads to increased labor costs which, of course, reduces corporate profitability. At this point, that typical scenario has not played itself out with US companies.

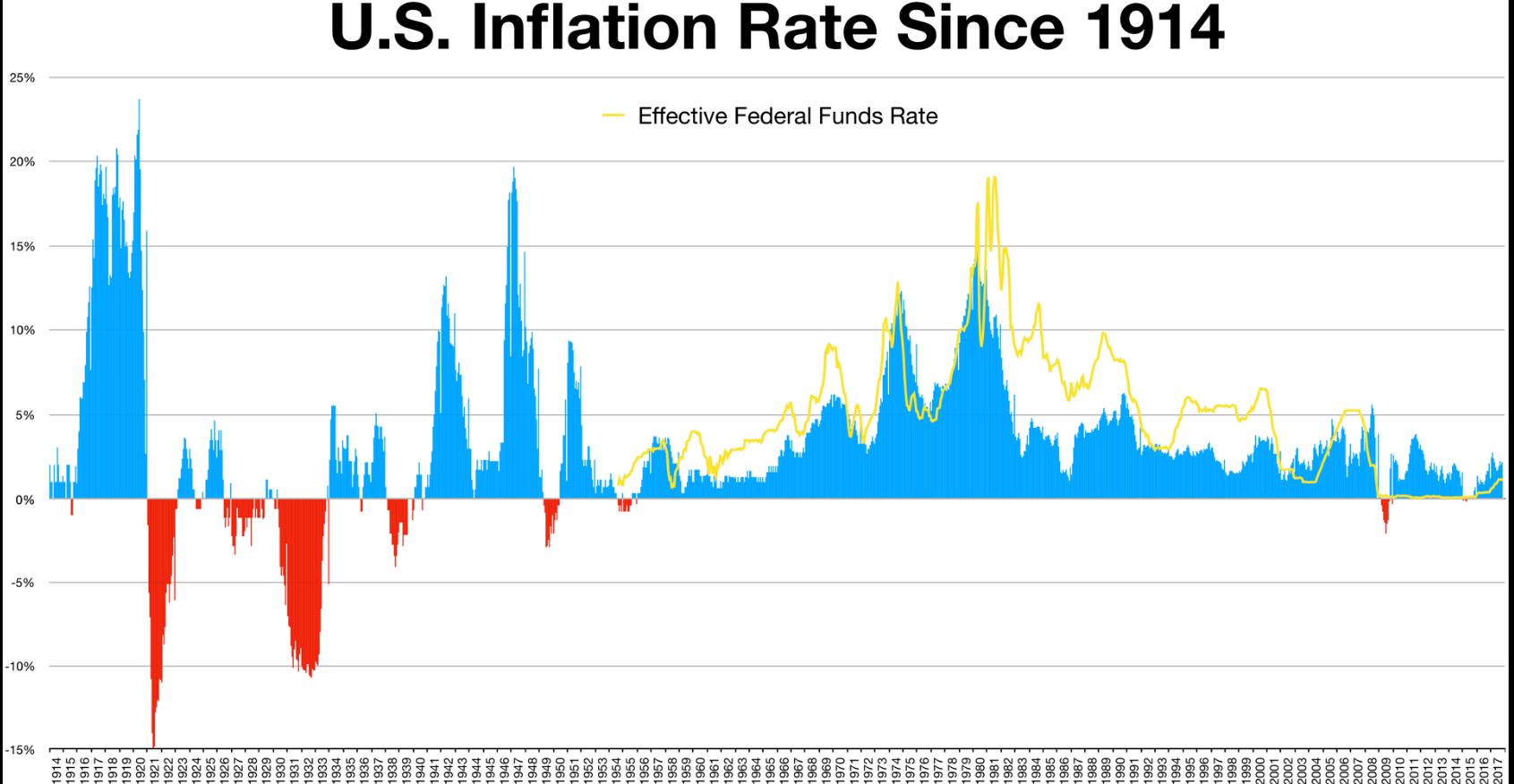

Related to the above is the risk of inflation. Currently inflation (defined as Core CPI) is hovering around 2.5%. While this is the highest it has read since late 2008, it still pales in comparison to historical inflation levels (see below):

Source: Federal Reserve Economic Data

Increased inflationary pressures *should* be an additional pressure on the markets. But inflation is difficult (if not impossible) to forecast in advance. There are many commentators that have been projecting inflation as an issue since 2009.

Trade War(s)

To me this may be the biggest issue facing the investment world. The ongoing trade war and associated tariffs with China particularly, are clearly impacting US based companies (and companies all over the world). I read this article over the weekend that details the global impact of these trade wars.

There is a running joke amongst financial professionals on Twitter that there is a news cycle that just goes around and around. First new sanctions are imposed followed closely by reports of an agreement being reached followed closely by reports of those agreement talks breaking down. Rinse and repeat. That certainly seems to be the pattern as an outsider.

This to me is a self inflicted wound lacking in much sense. People are affected in manufacturing, farming, hospitality, travel, investment and many other sectors. I don’t pretend to be an economist but I don’t think tariffs and trade restrictions are good for the markets long term. Time will tell if the issues are resolved and, if not, the impact.

Summary

These risks are all external in nature (for the most part). Time will tell when these risks start to become internalized and companies start to see pressures on their sales growth, etc.

This post is not intended to weigh all of the market’s positives and negatives. It certainly isn’t intended to provide advice specific to your situation. Rather, I just want to illustrate that there are many factors that go into the pricing in a particular market. Those factors can be materially influential at times and then be deemed almost insignificant at other times. Knowing which factors the market will deem critical at a particular point in time seems difficult, if not impossible. Block out as much of the noise as possible. CNBC, financial press, social media…heck even cocktail parties are filled with noise that can scare or enthrall you. Don’t make decisions based on what you hear or read in those forums.

As always, our advice remains simple: make certain you have clearly identified your goals and objectives and then make sure that your investments and assets align with those goals and objectives. Nothing could be worse for an investor’s sanity or likelihood of sticking with their financial plan than misaligned investments/goals. If you would like to discuss your plan or get started on building an aligned plan, please feel free to contact us.