I hesitate to even write this post because so much of the details are still unknown. But I would be doing clients a disservice if I didn’t at least broach the subject. This post is a broad overview of designated Opportunity Zones and their associated benefits.

What the heck are they?

Similar to Enterprise Zones, Opportunity Zones are designed to lure investment into poorer communities currently lacking investment. The Zones were wedged into the Tax Cut and Jobs Act signed last December but have received little press. Unfortunately, much of the regulatory guidance is not released so specifics are sketchy. But there are some very real general benefits that might be worth keeping in mind. There are zones in all 50 states and in parts of most major US cities including Baltimore and Washington DC. The program would allow for investment in the zones with the promise of no capital gain tax on any resulting gains if the investment is held for 10 years.

How does it work?

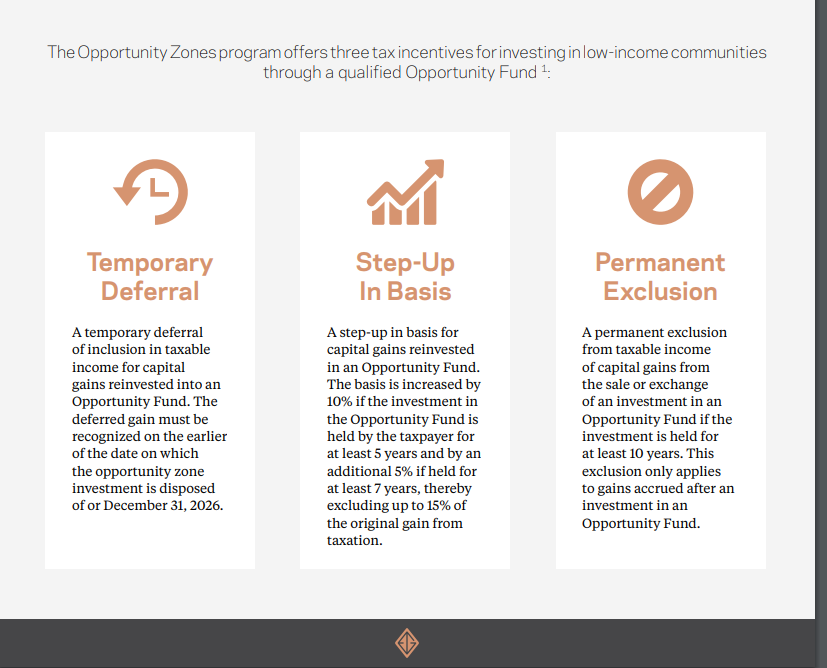

Basically, an investor could take a highly appreciated asset and “roll” these funds over into an Opportunity Fund. This “rollover” would have to occur within a stipulated time frame to reap the tax benefits. Immediately, the taxpayer would receive a benefit of deferring the tax on the gain. Additionally, the funds invested receive stepped up basis effectively shielding 15% of the gain from tax if held 7 years. Lastly, if the investment in the Opportunity Fund results in a gain and is held for 10 years, that gain is permanently excluded from tax (permanent exclusion does not apply to the previously deferred gain). That is the gist of it. Below is a chart, produced by the Economic Innovation Group, reinforcing the above benefits.

Sounds great what are the drawbacks?

Well there are certainly some drawbacks and here are the obvious ones that jump out to me:

- 10 years is a long time to fully realize the benefits. It is unclear what happens if the assets are held less than 10 years or if the Opportunity Fund sells assets during that time.

- The investment vehicle MUST be an Opportunity Fund (ie individuals can’t do this on their own). So there will certainly be some administrative costs and compliance at formation and throughout the life of the fund.

- Because of the nature of the benefits it seems to me that large, home run type returns (private equity, start ups, etc.) will be best suited for the Opportunity Zone investments rather than smaller investments with less return expectation (real estate).

So that is an quick primer on Opportunity Zones. If you have a potential large capital gain in the next few years and want to redeploy those investment dollars it will make sense to look at these Opportunity Funds and see if they make sense for those dollars.

If you would like to speak more specifically about Opportunity Zones, please don’t hesitate to contact us. Meantime, here is a podcast I recently listened to that provides some additional specifics.