Netflix (NFLX) reported it’s Q2 numbers after Monday afternoon’s close to much disappointment and hand wringing. Immediately, in after hours trading, the stock plummeted ultimately opening this morning down about 15%. The stock pared its losses as of mid day by more than half but this performance of NFLX today should be a stark reminder of the difficulty in predicting or timing the markets.

FANG stocks (defined as Facebook, Apple, Netflix and Google) have been the darling of financial media over the last several years. Not a quarter seems to go by without headlines blaring statements like “If you had invested $XX in Google XX years ago you would have trillions and trillions of dollars”. Perhaps I exaggerate but these are real headlined articles I found in a 30 second Google search:

What if You Invested In Apple 10 years ago?

What if You Invested in Alphabet (Google) at the Market Bottom?

What if You Invested in Facebook in 2012?

And if you just invested in a basket of FANG stocks there is an article for you too:

What if you just invested in FANG in 2014?

While these are interesting reads, I suppose, they are illustrative of exactly nothing in my opinion. In order to replicate these returns one would have to believe they can identify the next high flying security, actually invest in it, and hold on to the stock through inevitable drawdowns that occur along the way. I have a few problems with this expectation:

Sure, if we knew what was going to go up we would allocate our hard earned dollars there. I think its obvious that this just isn’t how the markets work. Stock picking is incredibly hard. If it were easy, where was everyone yesterday screaming to short NFLX and print money. But we all know that didn’t happen and that isn’t how the real investing world works.

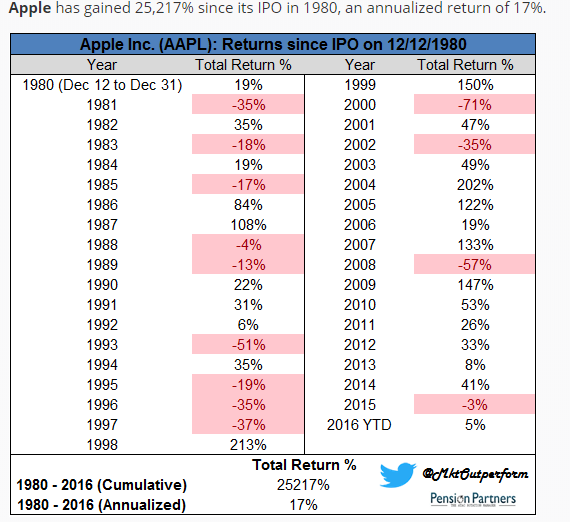

Drawdowns happen even in bull markets. Drawdowns happen to market leading stocks. Some of these drawdowns can be brutal. Charlie Bilello quantified these drawdowns on Apple since it went public in a blog post two years ago:

How investors behave during these inevitable drawdowns is crucial to realizing the gains touted in the above referenced columns. I don’t know too many investors that would have held on to Apple stock, or even added to it, in mid-2000. The stock fell day after day coupled with a barrage of bad press telling them what a dog the stock was made it difficult to hang on. It’s human nature to question decisions when all around you is stocks are crashing in and talking heads are telling you you are making mistakes. It isn’t realistic to expect investors to simply ride out these drawdowns and realize these incredible returns.

So how do we combat this built in difficulty in the markets? I sound like a broken record but purchasing low cost index mutual funds and ETFs is the best way to stay invested. I believe this and this is how I invest for myself and our clients. Knowing why we are investing in a specific way (planning) will allow us to later look at our financial holdings with a clear head and help us stay committed to our goals. Let us know if we can help get you started in that planning process.