I hesitate to write a review of the Senate tax bill that passed last weekend as it is unclear (1) that the House and the Senate can agree to the differences in their respective bills and (2) that both houses of Congress will retain enough votes to approve the final, marked up bill. And if both of those outcomes occur it is not entirely certain how the final bill will look.

The uncertainty surrounding this bill also doesn’t leave a lot of time for planning. However, there are some takeaways from the debate on each of the bills that can guide us in making some assumptions about the final bill. This is my attempt to summarize those key takeaways and some opportunities to consider before year end.

State and Local Tax Deduction (SALT)

One of the more publicized changes is to eliminate the SALT deduction. Currently this is the most common itemized deduction utilized by taxpayers. Both bills eliminate the deductibility of SALT payments but retain property tax deduction up to a $10,000 cap.

Opportunity: If you expect to owe SALT with your 2017 return consider paying those in 2017 while the deduction remains intact. There are other considerations but the timing of SALT deductions should be explored.

Standard Deduction and Personal Exemptions

Both bills essentially double the standard deduction and eliminate personal exemptions. This is a win for small families that don’t typically itemize their deductions. For families with multiple young children the loss of the personal exemptions is addressed by a larger Child Tax Credit.

Opportunity: If you expect to itemize in 2017 but probably won’t itemize in 2018 because of the higher standard deduction, consider bunching deductions in 2017 to get the full effect of those deductions. The most obvious thought would be to increase charitable giving into 2017 and taking the deduction for charitable contribution.

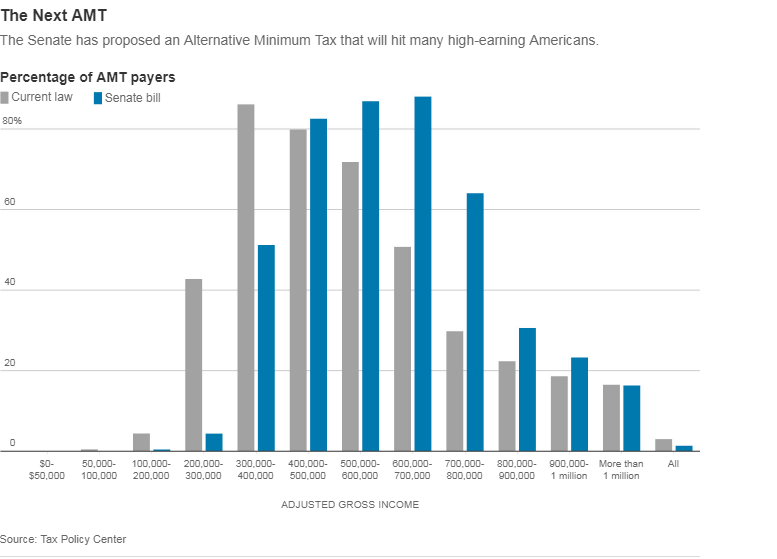

Alternative Minimum Tax (AMT)

AMT is mercifully killed in the house proposal but scaled back in the Senate version. Some of the items that impact AMT (SALT deduction and personal exemptions) are eliminated so far fewer people will pay the AMT beginning in 2018. This hated tax will, however, still impact taxpayers in higher income brackets. Below is a table taken from Friday’s Wall Street Journal article detailing the impact:

Pass-through Entity Provisions

Probably the most politically divisive issue is the change to taxation on so-called Pass-through Entities. These include S Corporations, LLCs and sole proprietorships and both bills reduce taxation on the income of these entities. The specifics of the bills differ in determining that reduction, however.

Opportunity: If one of these provisions finds its way into the final bill, it seems clear that pass-through income will be less taxed in 2018 then in 2017. So the goal would be to recognize more income after 12/31/2017 and, thus, bunch deductible expenses into 2017.

The overarching message I have is that tax rates are generally going down in 2018 and for the next few years. The time honored strategy of deferring income into future years while bunching expenses into 2017 makes more sense in this environment then it ever has. The final bill will provide more clarity but it is clear this bill, love it or hate it, will offer the most sweeping changes to the tax code in my 25 years in the business.

If you have any questions about the impact on you or your business, please feel free to contact us. As always, if you are interested in our financial planning and investment management services, please drop me a line.