I’m stealing this blog post title from a Washington Post column of the same name (behind a paywall):

This probably isn’t a surprise. The IRS has been teetering on the edge of mess status for a number of years. But the double whammy of the pandemic and Congress tasking them with processing various rounds of stimulus has been too much to handle…they are in full blown crisis mode.

According to the National Taxpayer Advocate, there are over 35 million tax returns that are unprocessed. This includes recently filed 2020 returns and older returns filed more than 12 months ago.

35 Million Unprocessed tax returns…yes 35 MILLION!

One of the more frustrating aspects of this as a tax preparer is that the IRS Commissioner has been fairly “Pollyanna” about the Service’s issues. As recently as June 23, 2021, he stated that there were 17.5 Million unprocessed returns. This is almost positively not true.

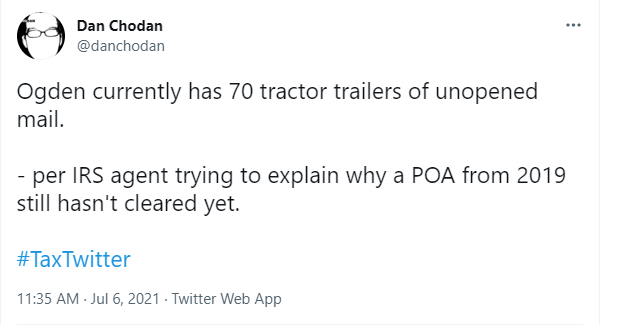

Anecdotally, there are reports of the Ogden, UT service center having tractor trailers full of unopened mail (I have seem multiple similar posts on social media).

Basically, any return filing “out of the ordinary” is going into a black hole of sorts, and we simply have to wait for responses. This includes amended return filings, responses to IRS computer generated letters and notices, etc. This is why we are electronically filing EVERY return that we can. We also are advising clients to receive refunds or pay tax liabilities electronically so there is an electronic “receipt” on those transactions.

Unfortunately, once a tax return is filed by our office, we have no more information than our clients. Phones calls aren’t answered. Hold times are laughably long. We have called the IRS on certain matters and been disconnected after 1hr+ on the phone. Clients have done the same for themselves. It’s dumbfoundingly frustrating. There simply is no way to follow up on some of these filings in an acceptable way.

All we can do is try and maintain high compliance with our filings to reduce the amount of correspondence we have with the Service.