In the last several days over social media, I have seen two stories on current tax related scams. I have seen neither myself but am not surprised at the sophistication.

Fake IRS Notices

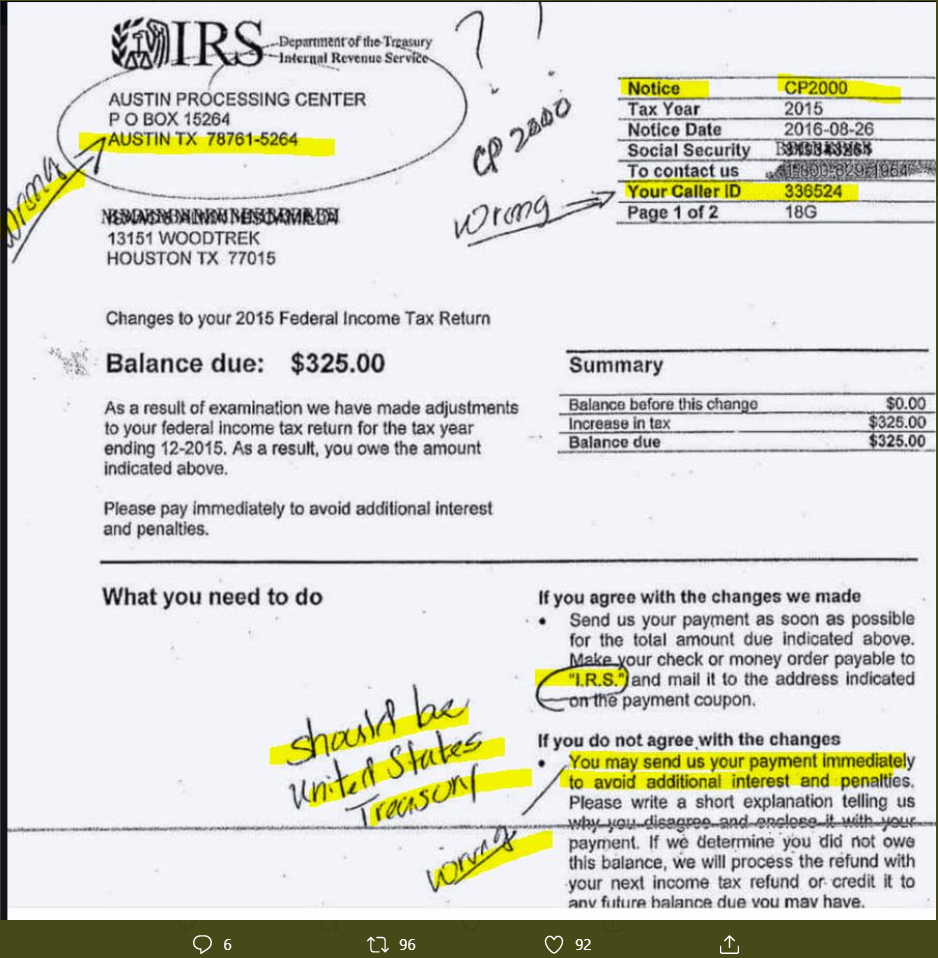

The first and probably most concerning is the fake IRS notification. I have long been surprised that this wasn’t more prevalent. As I have warned in the past, the IRS will never initiate contact with a taxpayer via phone, email, text message, etc. It will always initiate via traditional mail. Basically they have dummied up a notice to look ALMOST exactly like an IRS notice. The notice number is correct, the layout and style is the same, the look and feel is the same. The only differences are fairly obscure items like the response address, the caller ID and whom the check should be payable to (see below; notes and highlights are not mine):

My advice: be careful and if something doesn’t look correct or doesn’t make sense, please reach out to us or directly to the IRS 1-800-829-1040. Every CP2000 comes with a summary of why the IRS is proposing the change. If there is no explanation for the proposed change, it probably isn’t legit.

Cancelling Your Social Security Number

This is just another way scammers are trying to pry your SSN from you. They typically call the victim and say they are going to “cancel or suspend your social security number”. If you get a call like this, just hang up. This is a scam and there is no such thing as cancelling or suspending your SSN. Of course, the scammers main objective is to get that social security number from you. So we should never be providing that to ANYONE particularly an unsolicited phone call.

Here is a summary of some of the most common scams being run at the moment:

I have no idea how frequent these scams are but I know I have received a few calls asking me to reveal my SSN. Be alert and you shouldn’t have any issues.