The unfolding mess that is WeWork should provide some pause for retail investors. Private markets have long been considered a place to juice returns of giant institutional funds, the so-called “smart money”. What WeWork and several other high profile stock offerings have shown is that there is a lot of murkiness in the private markets and that adds considerably to the risk of investing.

What Happened?

By most accounts, WeWork provides a valuable product. They lease office space en masse, chop it up in to smaller pieces and sub-lease that space to others. This service can be tremendously valuable in the gig economy or to small companies that want a presence in a particular market but don’t want to lock in to a long term lease. We have clients who utilize WeWork for space as small as a single desk in a building and swear by the service. I suspect if they had focused on that core business model things wouldn’t have gotten so out of hand. Instead, their management (led largely by the founder Adam Neumann) tried to reframe WeWork as a technology company. They raised tremendous amounts of money in the private equity markets and used those funds to throw large parties, branch into corollary businesses and increase the scope of their corporate mission.

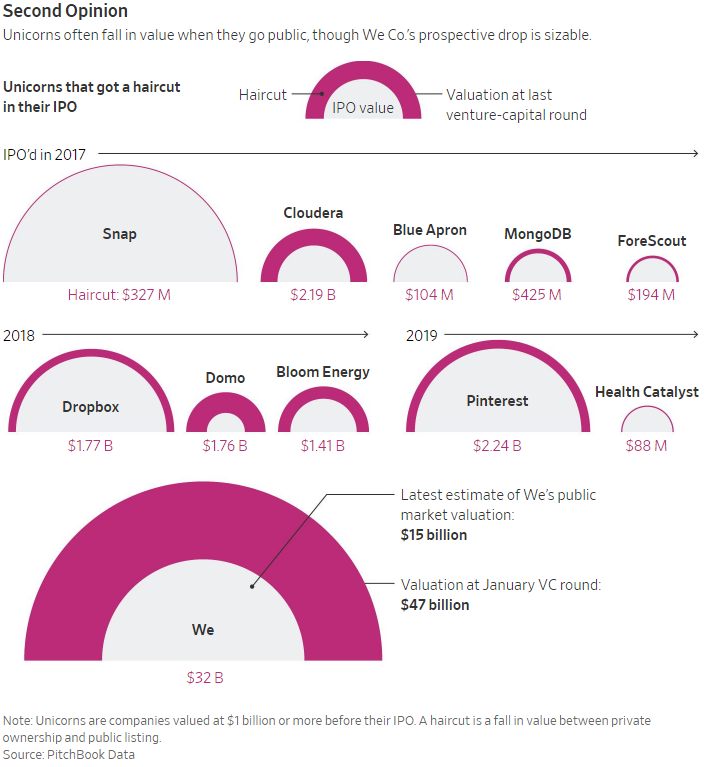

Somewhere along the line being an efficient lessor of office space wasn’t enough. Their mission statement laughably states that they wish to “elevate the world’s consciousness”. Mr. Neumann was given wide autonomy to do seemingly whatever he wished. He was involved in self dealings with that company that border on the egregious. The lack of corporate governance proved to be massively distasteful to the public markets. So when all of these problems became more apparent, the public markets balked. They expressed no interest in the initial IPO valuation cutting the prospective IPO price by nearly 2/3. Ultimately, We (now the legal name) decided to table the IPO until management could address the concerns. Time will tell if We returns to the public markets for another crack at an IPO.

Not an Isolated Case

Incredibly, We is not a unique case. While private markets provide the opportunity for HUGE returns they often do so in gray areas where disclosure requirements are far less than public markets. Public markets are much more regulated which increases costs and complexity to process. Functions like accounting, finance and corporate governance become equally important to a public company as sales growth. Several companies have made it to IPO only to see their stock plummet: Snap, Dropbox, Blue Apron and Pintrest are prominent examples in the last 2-3 years.

Source: https://www.wsj.com/articles/how-we-should-bust-an-investing-myth-11568991786

Some companies never make it to the public markets due to huge scandals prior to reaching IPO. Notably, Theranos was a house of cards that cost private equity investors 100’s of millions of dollars. For a full redux on Theranos and all of the fraud perpetrated by it’s founders I encourage you to read Bad Blood. It is one of the more remarkable books on business I have ever read and reads more like fiction than an actual accounting of what happened.

Impact on Investors

The takeaway for retail investors and more specifically my clients, is to be careful in non-public markets. This includes not just stock purchases but private placements, non-traded REITs, venture capital funds, etc. All of these investment vehicles operate in an opaque world where often a handful of investors determine the valuation of a business. Public markets, of course, offer the opportunity for millions of market players to help determine the appropriate market price of an investment. That’s a huge difference. If the public markets don’t like the way a company is governed they can press for changes to that management. Often in private investments management change is more difficult to obtain. Lastly, private equity is most often highly illiquid. Private equity proponents will tell you that is a feature not a bug. Perhaps they are correct. But long term lockups of funds are tough, particularly if the company has other issues swirling around.

None of this is to say that Private Equity is bad. Not by any means. PE often provides liquidity to the next great companies. They provide opportunities for HUGE payoffs often much higher than multiples achieved in public markets. Higher risk/higher reward and all of that. But investors who aren’t knowledgeable of the workings of PE or a non-public investment more generally, should proceed with caution. Ask questions, do due diligence, and if you aren’t 100% sure what you are getting into don’t be afraid to walk away.

This caution is also consistent with my message to clients to keep things simple. Virtually all of my clients financial plans and investment vehicles utilized are done with the goal of simplicity. This simplicity, while not sexy, equates to lower costs to invest and equates to a more understandable plan that is more likely to be stuck with.

As always, if you have questions about this post or more generally about our financial planning process, please don’t hesitate to contact us.