There is no sugar coating it…October was the worst month for the S&P 500 since September 2011. The results in the tech heavy NASDAQ were worse and resulted in that index’s biggest loss since November 2008. In the midst of this October selloff, there was no shortage of media pundits predicting massive selling and further market losses. CNBC even had special programming to cover the market volatility. Of course, this is all quite silly. The markets may, in fact, correct further. Or they may stabilize. Or they may continue an upward trend. Hard to know and even harder to act on properly. But for reference here was a story in Barron’s at the beginning of October before the market’s struggles:

The article is behind a paywall but the message in the title obviously relays the writer’s sentiment. Of course, many commentators calling for huge market corrections between now and some arbitrary date in the future. I won’t even reference the most egregious of these predictions. In most cases, the author or predictor is simply trying to scare readers into some sort of action that benefits the author. Selling their proprietary research or selling gold, bitcoin, etc. is often the goal. There is a veritable cottage industry in calling the top of the market and that leads to even more and more outrageous predictions.

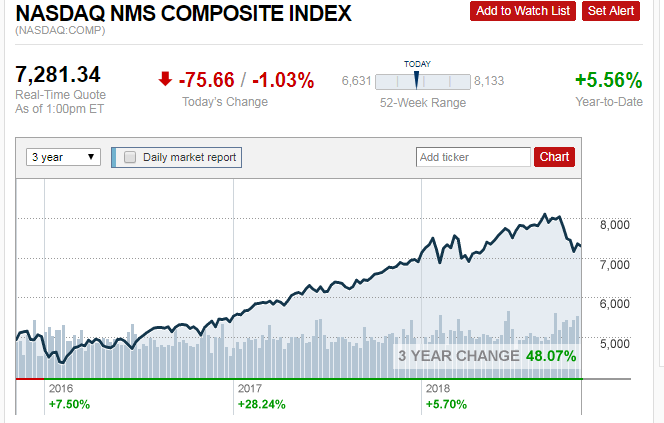

None of this is to dismiss the market performance in October as a one-off or to imply that it can’t won’t happen again. Because it almost certainly will. It’s likely to occur multiple times in most investor’s investment cycle. Rather my goal is to bring a bit of perspective to the markets. Yes October was painful. But year-to-date (YTD) the broad US indexes are up (as of this writing):

The foreign and emerging markets, meanwhile, have experienced tough sledding this year:

What Happened?

I’m not sure I can answer this definitively but it seems reasonable to look at a few different factors as impacting the markets:

- Rising Interest Rates-When rates rise the cost of borrowing obviously increases. This acts as a drag on corporate profits and ultimately their future earnings.

- Tariffs-I don’t think it is unreasonable to draw a straight line between the tariffs the current Administration is imposing and the sagging world markets. In many cases, the US is the largest trading partner with some of these foreign and emerging market countries.

- Political Uncertainty-Yesterday’s mid-term elections provided another variable of uncertainty. Markets generally hate uncertainty.

As I always state, however, it is impossible to know exactly what will or won’t effect the markets. Even after the fact it is difficult to know exactly what the tipping points were.

But many financial publications run columns responding to these market movements with titles such as “How to Survive the Next Bear Market” or the “Five Stocks You Must Own Now” or some variation of these. Generally those columns aren’t worth the paper they are printed on and you would do best to ignore the “advice” included in the columns. Occasionally though a good writer responds rationally and intelligently providing the type of advice that I think makes good investing sense. I found such a column written by Jonathan Clements. The article hits on all of the key points and does so in the context of one’s financial plan not simply making one-sized fits all recommendations. I can’t recommend this article enough.

October Markets-Jonathan Clements

Risk Tolerance

What to do? Stop fretting over short-term performance and instead focus on risk—from two vantage points. First, there’s the amount of risk it’s reasonable to take based on your investment time horizon and the riskiness of your broader financial life, including whether you have a regular paycheck and how secure it is.

Second, there’s the amount of risk you can stomach. No matter how long your time horizon, you shouldn’t invest heavily in stocks if you freak out over minor market dips.

It’s easy to be an long-term investor when the markets are going up month after month. Only when faced with adversity do we understand how these market drawdowns impact our emotions. Have you been honest assessing your appetite for risk? Does your response to this question change based on the performance of your portfolio? To me these are the most important questions your advisor can help you answer. A financial plan is critical. But if you can’t stomach the thought of losing money for stretches of time are you really committed to that plan?

Time Horizon

Time is the biggest ally of a well diversified portfolio. Sure, markets can will act irrationally over the short term (or even longer). But generally the longer one stays invested the more likely Modern Portfolio Theory works. This means those that take some risk are rewarded for that risk. This is necessary to grow the asset base and counteract the destructive impact on purchasing power that is inflation.

If you found yourself nervous about your investment holdings in October, please take some time to think about your appetite for risk and your investment time horizon. The answers to these questions coupled with investor reactions to uncertain times are more important than picking the right fund or ETF.

As always, let us know if we can help you with your financial plan.