I hope all reading had a great holiday season and wish everyone a healthy and prosperous 2022.

After 2 years of bizarre, seemingly never-ending tax seasons, we hoped for a return to normalcy this winter and spring. Alas, it does not appear Congress will keep up their end of the bargain. The US Senate seemed prepared to pass the Build Back Better Act in late December. This wide ranging bill had various tax components that would have impacted our clients. Ultimately the bill got bogged down in politics and tabled until this year.

Now the Act is being revisited in the Senate. I can’t keep track of the proposals and the prospects of passage as they change hourly. I do know that there is serious discussions of at least one hot button tax provision applying RETROACTIVELY into 2021. That provision is, of course, the so-called SALT limitation. If passed, it appears that the SALT cap will either be increased from the current 10k per taxpayer or increased for taxpayers below a certain income threshold. I detailed this back in November when the BBB was gaining steam. SALT Provisions

It would have been nice to know this was a possibility IN 2021 so we could have advised clients on this law. As it stands now, we are in a wait and see mode to determine if BBB passes and, if so, whether it has any retroactive features. Of course, this will likely delay the start to our filing season for income tax returns expected to be impacted by this change.

Another change, for the moment, is that the Advance Child Tax Credit has stopped as of December. If you were receiving those payments in the second half of 2021, DO NOT expect those payments on January 15. BBB will address these payments but for now they are no longer scheduled.

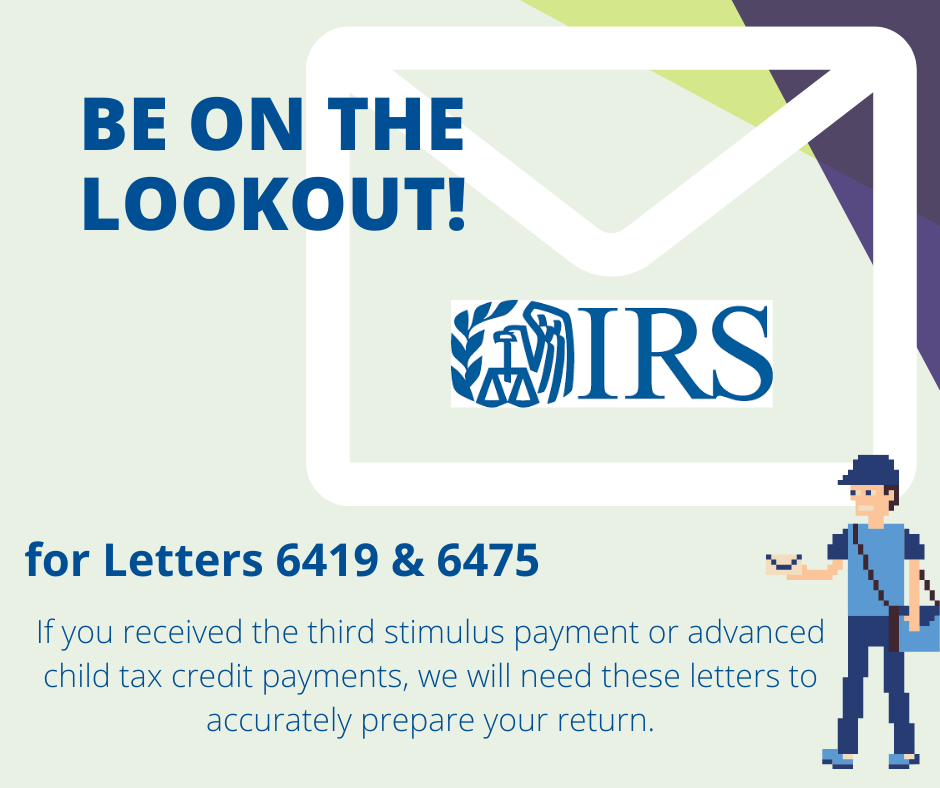

We will keep you abreast of any changes as soon as they occur. For now, if you received the Advanced Child Tax Credit OR the third stimulus payment you will shortly be receiving letters about those payments. PLEASE RETAIN THOSE AND GET TO US AS PART OF YOUR TAX PREPARATION. Failure to do so could lead to slower than normal tax preparation or refund processing.